Archive for the ‘Salary’ Category

November 14, 2012

November 14, 2012

There is nothing more humbling than updating a web site and realizing that the road you were previously on was much better than the path you are currently taking. There was a time in which we had such vigor when it came to our bills, finances and savings. Sadly though it is a wakeup call as I look at the rising amount of debt that my family and I have accumulated and man do we have a task at hand. Now granted where we are sitting is not nearly as bad as what others may be dealing with so this is definitely something that I am thankful for.

I have updated the Debt Snowball with the most accurate information I have and believe it is pretty reliable. Now with all that said our debt comes in just a little over $88,000 with no money in savings, living paycheck-to-paycheck and that buck stops here. No more am I going to be stuck where we’ve been and the time is now.

Can you feel the motivation? Can you since the excitement in my voice? I look forward to being able to successfully sign off on the $1,000 Emergency Fund. I am ready to be done with the first baby step as we’ve been here before. Now though I must concentrate upon getting from zero to one thousand and as stated before….energy flows where attention goes. $1,000….here we come baby!

Posted in Barack Obama, Budgeting, Budgets, Collections, Commission, Dave Ramsey, Debt, Debt Is Dumb, Defaulted Loans, Defaulted Student Loans, Economic Woes, Federal Loans, Financial Budgets, Financial Freedom, Financial Peace, Financial Prosperity, Fiscal Responsibility, Foreclosure, Foreclosures, Friends, Gazelle Intensity, Hard Worker, I love money, Life, Living on a Budget, Luxury, Management, Millionaire Next Door, Millionaires, Money, Necessities, Necessity, Personal Finance, Pikers, Recession, Reduce Debt, Reducing Debt, Salary, Sales, Sales Force, Savings, Savior Obama, Spending | Leave a Comment »

November 14, 2012

November 14, 2012

So the more and more that I start to focus in on this financial fitness mumbo jumbo the more that I realize there are a ton of people (just like me) who are financially out-of-shape yet try to appear as if they are financially fit. Whether it be the neighbor down the street or the stranger in the grocery store the fact is there are more and more people trying to live up to the Jones’ expectations.

Sadly though I understand that the Jones’ and my expectations are going to be two totally different concepts. To be honest with you it sucks trying to save money. It is so much easier to keep blowing money but I’d rather not have fun and reap the benefits of saving money than have to deal with the stresses of having more month than money left.

In just a few days I will be celebrating Thirty-One years of being on this earth and sadly for almost all of those years I have been held captive to the slavery of debt. Now I am hoping to break through these chains with a fierceness that will leave the debt trembling into oblivion. The focus needs to be positive and needs to hone in on the baby steps of Dave Ramsey’s program. The very first thing we are going to have to concentrate upon is going to be obtaining $1,000 in our emergency fund to get past baby step one.

Now with that said in the next couple of days it is imperative that my family and I sit down and map out the dreaded budget. It is all about trying to find the right budget though because it cannot be too tough (get discouraged and quit) and not be too loose (not make any traction). If you are where I am, or have been where I am, or you are going to be getting at my starting point….feel free to voice your opinion here.

Posted in Bonus Checks, Bottom Feeders, Budgeting, Budgets, Dave Ramsey, Debt, Debt Is Dumb, Driving Numbers, Economic Woes, Federal Loans, Financial Budgets, Financial Freedom, Financial Peace, Financial Prosperity, Fiscal Responsibility, Foreclosure, Foreclosures, Gazelle Intensity, Hard Worker, I love money, Life, Living on a Budget, Losers, Luxury, Management, Messiah Obama, Millionaire Next Door, Millionaires, Money, Necessities, Necessity, New Year's Resolutions, Personal Finance, Pikers, Recession, Reduce Debt, Reducing Debt, Salary, Sales, Savings, Savior Obama, Spending | Leave a Comment »

November 12, 2012

November 12, 2012

Just getting back into the thicket of this thing called becoming financially free and I must say that I am a little bit tingly about it. There are a couple of things that I realize that need to happen as I write this. The very first thing that I need to do is to evaluate where I am right now and where it is that I want to go. Obviously the end result is becoming debt free but instead of just saying this is where I want to be…I need to give great thought and detail to exactly how I’m going to get there.

There is a saying in the movie The Secret in which it states that energy flows where attention goes. How true is that? If a person wants to lose weight and they start focusing in on losing weight and putting their efforts to weight loss….what happens? They lose weight, right? Typically the answer is yes. So with that said….it is definitely time that I put my focus on losing debt. How great does that sound?

Secretly I am smiling on the inside as I write this tonight with my wife sitting next to me as we are watching the tube. Other than deciding that I need to become more active with the blog, I have also decided to pick up the Total Money Makeover book by Dave Ramsey off the shelf. The first thing I had to do was blow the dust off the cover but the pages are crisp and ripe for the reading. Here’s to the start of what will be many, many blog posts (hopefully).

If you’re reading this I hope you are able to help keep me and my family accountable with our daily grind and battle with debt.

Posted in Bonus Checks, Budgeting, Budgets, Dave Ramsey, Debt, Debt Is Dumb, Financial Budgets, Financial Freedom, Financial Peace, Financial Prosperity, Fiscal Responsibility, Gazelle Intensity, I love money, Life, Living on a Budget, Millionaire Next Door, Millionaires, Money, Necessities, Necessity, New Year's Resolutions, Personal Finance, Reduce Debt, Reducing Debt, Salary, Sales, Sales Force, Savings, Spending | Leave a Comment »

November 12, 2012

November 12, 2012

Let’s see here…it is November 11th, 2012, and the last post that I have on here came back in January. Doing some simple math here it has been over 300 days since my last post and I am going to make a conscious effort to get my gazelle intensity back when it comes to our finances. There have been some changes in our family that I will address later as I initially just want to make sure this post gets posted.

There is going to be some changes made and it’s going to be brought forth through this blogging site and unfortunately I have been absent with my presence on this site as well as absent when it comes to making my family’s finances a main issue that we can beat. Anyways, there will be more to come….just not tonight.

Posted in Barack Obama, Budgeting, Budgets, Dave Ramsey, Debt, Debt Is Dumb, Financial Budgets, Financial Freedom, Financial Peace, Financial Prosperity, Fiscal Responsibility, Gazelle Intensity, Life, Living on a Budget, Losers, Millionaire Next Door, Millionaires, Money, Personal Finance, Recession, Reduce Debt, Reducing Debt, Salary, Savings, Spending, Stimulus Package, Taxes, Work Ethic | Leave a Comment »

January 9, 2012

January 9, 2012

It is amazing to me how easy it is to fall off the wagon of life. When I mention this wagon of life you can almost insert any word pertaining to that wagon. Whether it be working out, living on a budget, eating right, doing better at work, whatever that list might pertain the fact is it is easier to go back to slacker ways than to keep moving forward. I cannot but chuckle to myself as I looked on this site to realize that my last post for this site was almost one year ago. In fact it was 10 months ago the last time that I thought to myself I want to get back on my budget.

Truth be told I am not alone in my battle against debt. Let me take that back, I am not alone in my personal war on debt. So I am hopping on the wagon again and this time I am hoping that I can maintain my focus on slimming down my debt as well as slimming down my waistline. I love the lay out of my site here and I have decided to use this as my thoughts on everyday life. I am sure that we will laugh together, we will cry together, maybe disagree with each other, but one things for sure I plan on expressing my ideas and my goal in 2012 is to be able to claim that I am, “Debt Free!” I have made the mistake in the past of falling off the wagon and to be honest I am sick and tired of being sick and tired.

I’m taking the financial challenge in Twenty Twelve to becoming more financially fit as well as physically fit and this is going to be my stomping ground in doing so. Also I plan on setting the stage here as I grow as a Christian. Like I said this is going to be a mixture of all things in my life because I cannot grow in one area without growing in others. Here’s my spiderweb, let’s weave this web together!

Posted in Bonus Checks, Bottom Feeders, Budgeting, Budgets, Dave Ramsey, Debt, Debt Is Dumb, Driving Numbers, Economic Woes, Financial Budgets, Financial Freedom, Financial Peace, Financial Prosperity, Fiscal Responsibility, Gazelle Intensity, Hard Worker, I love money, Life, Living on a Budget, Losers, Luxury, Management, Millionaire Next Door, Millionaires, Money, Necessities, Necessity, New Year's Resolutions, Personal Finance, Recession, Reduce Debt, Reducing Debt, Salary, Sales, Sales Force, Savings, Sick, Spending, Stimulus Package, Taxes | Leave a Comment »

March 26, 2011

March 26, 2011

After starting and stopping then starting and stopping again my wife and I have finally decided to make a solid push to the gazelle intensity of being debt-free. In fact with the way we have our finances set up we should complete the first baby step (saving $1,000 as an emergency fund) by the 8th of April. At that point in time we will be looking at our snowball and what we can do to make the debt decrease to where it is nil.

We’ve also started considering and have decided to partake in a home-based business for my wife of selling jewelry. There’s an initial upfront investment but we have several friends of the family who have been able to make a steady profit from the business. One of these individuals grosses a monthly income of $15,000 per month from the line of work and I must admit I was skeptical at first until I saw the numbers myself.

With that said these people do not treat this business as a part-time job but attack it as a passion to do well. Now does everyone make this kind of money per month? The answer is simply no but I do believe a person will reap the benefits of what they sow. Ideally I would like to build the business up to about $8,000 per month. I figure this would be a solid way to change the rest of our lives. With that kind of money coming in would mean that my focus on employment would turn to this line of work. I expect to get to this level would take us some where between 6-8 years of steadily pushing the business.

I think to myself what we could do with this amount of money and if we take the Dave Ramsey method of living simple I can only imagine the amount of money we could put back. I understand it doesn’t hurt dreaming but I am bound and determine to make this a success. I would love to be able to stay-at-home with my wife and master this business working it daily together. Only time will tell but I must admit I am excited to get started!

Posted in Bonus Checks, Bottom Feeders, Budgeting, Budgets, Commission, Dave Ramsey, Debt, Debt Is Dumb, Driving Numbers, Financial Budgets, Financial Freedom, Financial Peace, Financial Prosperity, Fiscal Responsibility, Gazelle Intensity, Hard Worker, I love money, Living on a Budget, Money, Personal Finance, Salary, Sales, Sales Force, Savings, Work Ethic | Leave a Comment »

March 25, 2011

March 25, 2011

The realization has hit me that the longer we live the more expensive life becomes. I’m trying to maintain my focus upon getting out of debt but I must say that it is so much easier trying not to worry about the fiscal catastrophes that are crumbling down all around us. I’m trying to get back into my motivational money craze to see what I can do to get out of debt. As Dave Ramsey has said before, “I’m sick and tired of being sick and tired.”

I’ve got to rethink my position and see what it is I can do to get the cash rolling in and make a difference. Next step is to start praying for some guidance and the following step will be putting my ideas into action.

Posted in Budgeting, Budgets, Dave Ramsey, Debt, Debt Is Dumb, I love money, Millionaire Next Door, Money, Personal Finance, Reduce Debt, Reducing Debt, Salary, Savings, Spending | Leave a Comment »

September 24, 2010

September 24, 2010

I love the fact that I control my own destiny. The decisions we make today affect the circumstances of tomorrow. Our society in the U.S., throughout the world will never see everyone try to reach their potential. Never. Look around now and I’m sure you can name several people who are fine with barely getting by and not interested in bettering their situation. I know people like this and I know you do too. If everyone became exceptional then the next step would be to raise the bar.

Look around at the horse and buggy industry, it’s been put out of business by people who raised the bar higher and developed a better system known as the automobile. Look at the advancements in that industry seems to me the exceptionable accomplishments keep getting higher. This is one example but when you reach one plateau start going towards the next. People fail to be exceptional by becoming content with where they’re presently at.

Again a person will never be self sufficient waiting on other people to provide for them. What’s it teach? Depend upon others to get what you want? It’s just not my view of the world and everything that I have is because I have earned it. At the end of the day no one can take that away from me. I’m proud of what I have accomplished and I have had obstacles that I had to endure earlier in life that prepared me for the future.

Posted in Bailout, Barack Obama, Bottom Feeders, Debt, Debt Is Dumb, Defaulted Loans, Defaulted Student Loans, Economic Woes, Financial Budgets, Financial Freedom, Financial Peace, Financial Prosperity, Fiscal Responsibility, Friends, Gazelle Intensity, I love money, Life, Losers, Messiah Obama, Money, Necessities, Necessity, Personal Finance, Pikers, Recession, Salary, Savior Obama, Spending, Stimulus Package, Student Loan Justice, Student Loans, Taxes, Top Performer | Leave a Comment »

September 24, 2010

September 24, 2010

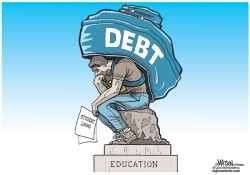

I’m thinking back to a post that I wrote in December of last year about the excuses people make regarding student loans. Almost 11 months later and I am still just as puzzled today as I was back then as to why people continue to make excuses as to why they cannot pay back on their educational loans. I think the biggest reasoning is that too many people want to be the victim when it comes to dealing with their student loans. The victim, are you serious?

Recently there was an article that came out detailing how student loans have now taken over as the largest debt owed in our country as $830 billion goes to student loan debt with $825 billion being that of credit card debt. A person has to wonder truly what the big deal is as our society has turned to one where it is important to get an education. If we traveled back in time 40 years ago the ideology of going to college was a luxury as it was not uncommon to land a good job with just a high school education.

Flash forward to the times of today and in this economy it is crucial in having a degree to be able to land good employment. I’ve been approached in the past by parents telling me how their children are over qualified to work at McDonald’s, or any other fast food restaurant. I cannot believe that parents are so naïve that they would actually believe this. Any time I have needed a second job I have been able to walk into a fast food establishment and land a job shortly after completing the application. For these parents believing their kids that they (the kids) are overqualified is completely asinine.

The problem with our country is that nobody wants to step up to the plate and take ownership for their actions. Not too long ago a college professor shot up her department heads during a meeting and defense attorneys were quick to call insanity. This is yet another case where people are too afraid to admit their actions. The beds we sleep in today are from what we made yesterday and the beds we’ll sleep in tomorrow are being made today.

Even though student loans may be a larger debt in America than credit cards the difference is the advantages given by having the degree. Failing to pay a student loan back is part of the instant-gratification attitude of those graduating today. Amazing how no one wants to pay their bills compared to the days of our grandparents. What will the future of this country look like as these people become the leaders of tomorrow?

Posted in Bailout, Barack Obama, Bottom Feeders, Budgeting, Budgets, Collections, Dave Ramsey, Debt, Debt Is Dumb, Defaulted Loans, Defaulted Student Loans, Democrats, Economic Woes, Federal Loans, Financial Budgets, Financial Freedom, Financial Peace, Financial Prosperity, Fiscal Responsibility, Friends, Gazelle Intensity, GOP, I love money, Life, Living on a Budget, Money, Personal Finance, Pikers, Recession, Republicans, Salary, Savings, Stimulus Package, Student Loan Justice, Student Loans, Taxes | Leave a Comment »

September 24, 2010

September 24, 2010

What do I want to do when I grow up? This is a common question that we pose to children on a frequent basis. The answers vary and if you were to ask my children what they wanted to be when they grow up the answers too would vary from being Dora the Explorer, a Princess, a Mermaid, to even being a mommy. When the answers are given though the common phrase is based around the ideology that a kid can be whatever it is they want to be when they grow up.

How far is this from the truth? The older I get the farther away from what I wanted to be when I was kid I become. With age comes a sense of reality and that reality is that bills need to be paid, food needs to be on the table, and the American dream will always be just that…a dream. What causes us to go from believing in our children to suddenly stifling out and killing their childhood dreams?

Now granted there are certain responsibilities that we take on as adults in trying to make it through the day-to-day grind. Simply put more Americans are merely trying to survive than live out their dream of what they want to be when they grow up. Instead of being a doctor kids take the easier road and become a business major. Instead of being a nurse kids decide to be secretaries. At some point in time we go from believing in the impossible to living for the path of least resistance.

My goal is stop that cycle within my own life. I’m here to dig deep and find out what that dream was of what I wanted to be when I grew up. Now granted I know what my responses were in the past but I now understand throwing a baseball 110 mph on a major league field is not feasible. What I need to do is find out who I am, what my dreams are, and how I can amply apply my abilities to living out my dream. It sounds simple. I understand where I’m at right now and I know the end destination that I want but the hard part is going to be finding my way from point A to point B. In discovering my inner ambitions I expect to find out more about who I truly am. I expect to learn more about what motivates me, what excites me, what I am truly passionate about. In doing all of this I expect to find the answer to the common question of what I want to do when I grow up. When I get where I’m going I am positive there will be a “new” me living the life I have always wanted. I’ll finally being living the life I dreamed about, finally living the life I was destined for.

Posted in Bailout, Barack Obama, Bottom Feeders, Budgeting, Budgets, Dave Ramsey, Debt, Debt Is Dumb, Defaulted Loans, Defaulted Student Loans, Economic Woes, Entertainment, Financial Budgets, Financial Freedom, Financial Peace, Financial Prosperity, Fiscal Responsibility, Foreclosure, Foreclosures, Friends, Gazelle Intensity, Life, Millionaire Next Door, Millionaires, Money, Pikers, Recession, Salary, Sales, Sales Force, Student Loan Justice, Student Loans, Taxes | Leave a Comment »